Blog

Blog

Exports, a pillar of the pork industry in Chile

15th November 2024 - News

Pork production in Chile is distinguished by being intensive, highly technological, and vertically integrated throughout the entire production chain. This has allowed this sector to focus on exports effectively. Thus, Chile has positioned itself as one of the leading pork exporters worldwide and is the third largest exporter in Latin America, after Brazil and Mexico.

Production

The pork industry has established itself as a fundamental pillar within the Chilean livestock sector. According to Interporc data, in 2023, Chilean pork production was maintained at around seven or eight thousand farms. However, commercial farms would be around 70 (most located in Santiago, O’Higgins, and Maule). These farms stand out for using advanced animal farming technologies and maintaining high levels of biosecurity.

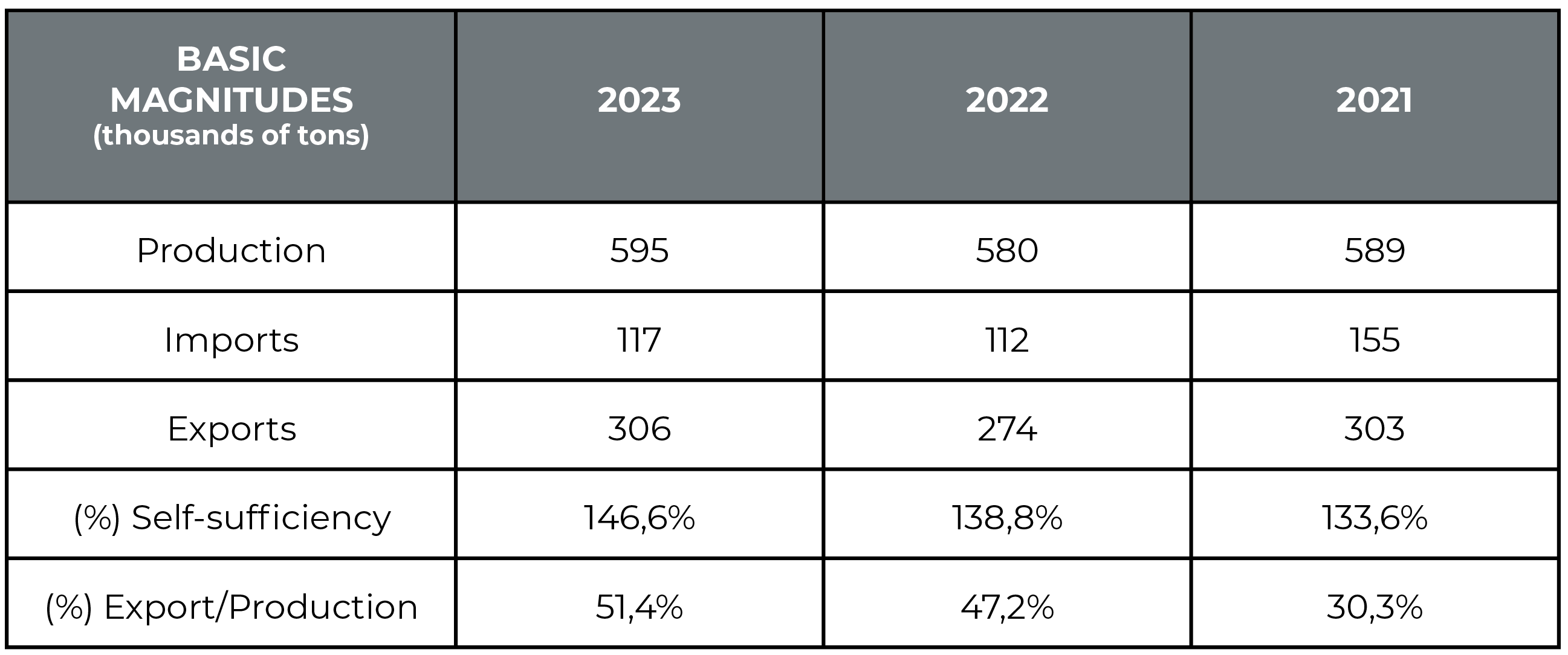

Thanks to this well-defined structure, Chile slaughtered 5.5 million pigs and produced 595 million tons of pork in 2023, around 2.5% more than in 2022. The Chilean pork industry not only focuses on producing fresh meat but also has a strong presence in the production of pork products. These high-quality products stand out in the international market for their price competitiveness.

Market and internationalisation

One of the most notable characteristics of the Chilean pork sector is its high export capacity. In 2023, 57% of production was exported, reaching 306,000 tons. The main destinations for Chilean pork were Japan, South Korea, China, and Russia, demonstrating the internationalisation and diversification of the Chilean market.

Despite this high export capacity, the sector relies on imports to meet domestic demand. In 2023, Chile imported 116,000 tonnes of pork meat and processed products worth 299.36 million euros. Brazil, the United States, and Spain were the leading pork suppliers, contributing 5% of the total volume of Chilean pork imports in 2023.

These figures show that the structure of pork self-sufficiency in the Chilean market is characterised by dependence on imports, a strong export direction, and a high degree of self-sufficiency.

Pork consumption

The Chilean market shows a high demand for meat in general, with a per capita consumption close to 90 kilos per inhabitant per year. Within this total, chicken meat is the most consumed, with 43%, followed by beef, 30%, and pork, 26%. This last percentage translates into a total consumption of meat and pork products of approximately 406,000 tonnes, equivalent to a per capita consumption of 20.7 kilos per inhabitant per year.

Despite the slight decline in pork consumption over the last two years, the demand for this food is expected to continue growing and may even reach the figures for beef. This change is due to the higher price of beef and Chilean consumers’ greater preference for pork products.

Challenges

Maintaining international competitiveness is the main challenge facing the Chilean pork sector while working to meet growing domestic demand. Despite its self-sufficiency, with a self-sufficiency level of 146.6%, the country must balance domestic production with imports to ensure a steady and adequate pork supply.

In conclusion, the Chilean pork sector has consolidated a robust and expanding structure, with a strong export direction and continuing growth in domestic consumption. The industry’s ability to adapt to new market realities, innovate in production practices, and be open to emerging markets will be crucial to its future development.

Source: Interporc.