Blog

Blog

Japan consolidates its position as a strategic market for exporters

24th September 2021 - News

Source: ICEX.

In recent years, Japan has positioned itself as the tenth country with the most pork produced worldwide. However, its production is insufficient to cover national demand, making the Japanese country a large strategic market. Spanish exporting companies have known how to take advantage of this market niche and have made Spain the third country that exports the most pork to Japan in terms of value and the fourth in terms of volume.

Production

According to the study Meat Market Review FAO, published in April 2020, Japan ranks tenth in its ranking of the world pig meat producers. In 2020 alone, the Japanese country produced more than 900,000 tons of pork, mainly in the Kagoshima, Miyazaki and Hokkaido areas. These regions had 30.5% of all national production.

Despite being one of the largest producing countries, local production cannot meet domestic demand due to the low land devoted to livestock, farms’ low profitability, and strict environmental and health regulations. For this reason, there is a significant dependence on imports, and 50% of the pork consumed in Japan comes from abroad.

Imports

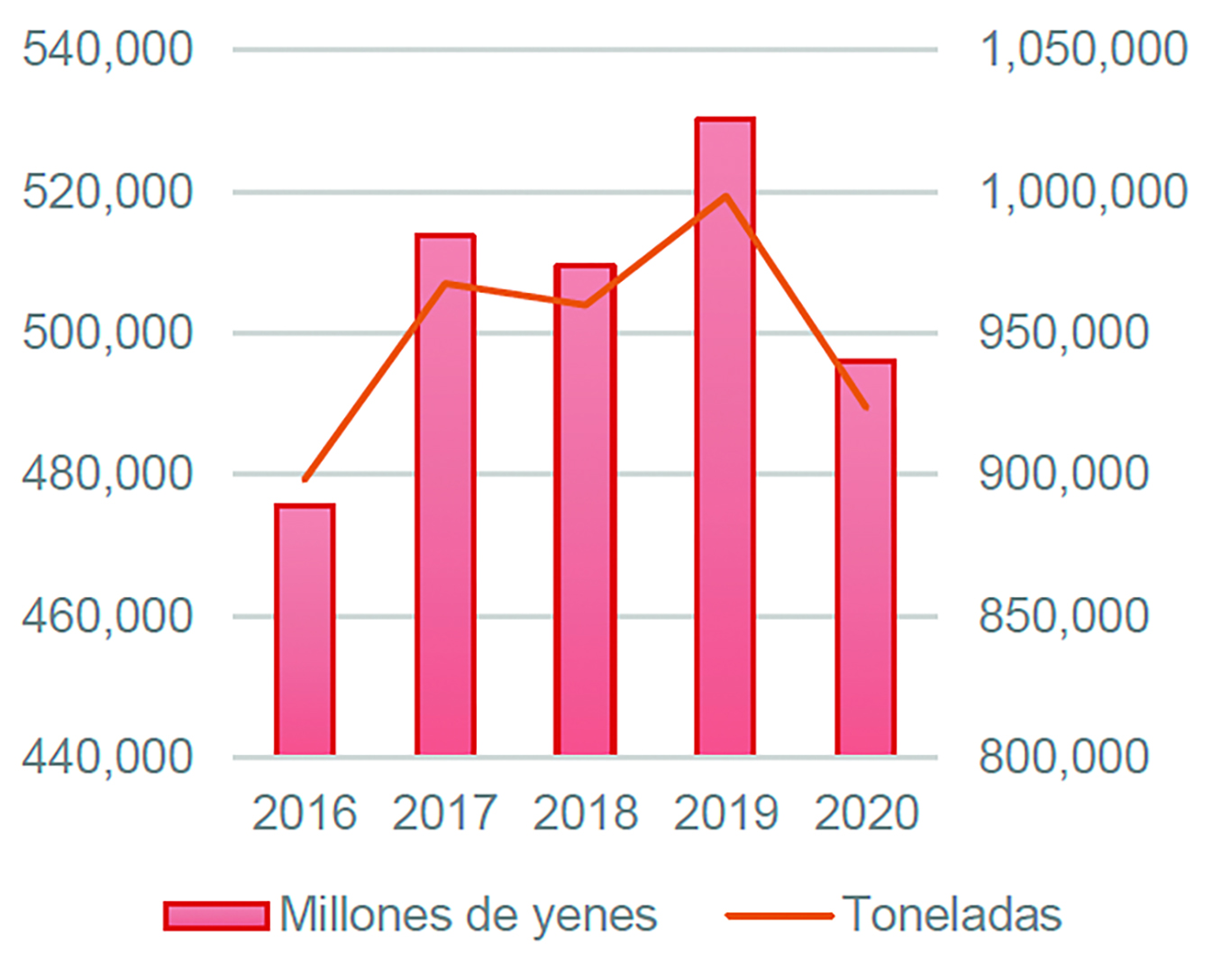

Pork imports have reached 923,835 tons in the last year (7.4% less than in 2019) and 496,109 million yen (about 4,070 million euros). Between 2016 and 2020 (Graph 1), imports became more relevant worldwide, placing Japan as the second-largest importer of pork in the world, only behind China.

However, due to restaurants’ temporary closure due to the global pandemic, in 2020, Japanese imports decreased compared to 2019 (-6.4%). Despite this, the global data for 2020 is higher than for 2016, mainly thanks to imports of fresh and refrigerated meat.

GRAPH 1. EVOLUTION OF TOTAL VALUE OF JAPANESE IMPORTS

Regarding Spain’s role in the Japanese market, the country has consolidated its third position in global ranking by value and fourth position by volume, after being surpassed by Mexico in 2020. According to data from Japanese customs, Spanish imports of pork in Japan have experienced an increase of 20.6% in value figures in the 2016-2020 period, while growth in volume figures has been 16.9 %. Although import data is lower than in previous years, the evolution of the Spanish trend is positive and presents optimistic expectations in the medium term.

Local product value

Faced with increased imports, local producers have tried to maintain their market share by distinguishing local meat through the quality of the “Made in Japan” product so that local origin is considered as an added value. This strategy is part of the plan of the Japanese Ministry of Agriculture, Fisheries and Forestry, which works to promote the local origin of the products, instead of fighting for the price.

Interior of a gestation farm in Japan. Photo: Rotecna.

Consumption

The consumption of pork in the country has experienced an increasing rise in recent years, parallel to the growing influence of western cuisine and the decrease in fish consumption, factors that have positioned Japan, in terms of demand, as the sixth-largest market for pig meat by volume, only surpassed by China, USA, Germany, Russia and Brazil.

According to data from the Japanese Ministry of Agriculture, Fisheries and Forestry, Japanese households disbursed an average of 56 euros a year in their shopping baskets in 2018. In 2019, this amount rose to 62 euros. To this should be added the consumption made in takeaway food and the Horeca channel, both very relevant in Japan. This meat consumption has been higher among the younger population, whose diet is moving away from the traditional Japanese one, where fish and vegetables prevail.

On the other hand, the consumption of Spanish ham is also growing in Japan. This food is usually consumed outside the home, mainly in Spanish restaurants, although it is increasing in supermarkets.

The emergence of COVID-19 has also meant a modification in consumption habits and distribution channels. In this sense, the Horeca channel has seen its importance drastically reduced. On the contrary, consumption has become highly relevant in-home, where prepared dishes have enjoyed tremendous acceptance and demand.

Future

The pork market in Japan is in a mature phase and still has positive growth figures. According to Euromonitor data, sales have increased 1.6% between 2014 and 2019, and growth is estimated to reach 4.3% in 2024.