Blog

Blog

Pork production grows in Colombia

11th February 2025 - News

The pork sector in Colombia has shown remarkable growth in the last decade and has positioned itself as one of the country's key drivers of agricultural production. With sustained growth and a 137.5% increase in production since 2012, the country ranks fifth among the largest pork producers in Latin America. This growth has been driven by technological advances, a significant increase in consumption, and the work carried out by the leading professional associations in the country's pork sector. However, the market faces challenges, such as dependence on imports to meet growing demand and the impact of production costs. This has motivated the adoption of technological innovations to ensure sustainability and competitiveness in the sector.

Size and structure of the sector

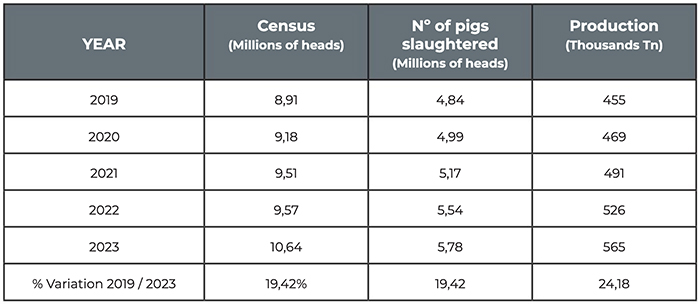

In 2023, Colombia slaughtered 5.78 million pigs and produced 564,780 tons of pork, marking a growth of 24.18% between 2019 and 2023 (Table 1), the most significant increase among the different pork sectors in the Americas. This notable rise places the country as the fifth largest producer in Latin America, behind Brazil, Mexico, Argentina and Chile.

In 2023, the Colombian pork sector had a census of 10.64 million pigs spread over 190,000 farms. Antioquia, Valle del Cauca and Bogotá regions are responsible for much of the production since 75% of Colombian pork production comes from these three regions. These areas combine technified and backyard systems, although the trend is towards greater industrialisation to increase production efficiency. In this sense, 3% of technified farms already contribute 72% of the pigs slaughtered.

Table 1. Colombian pig production.

Domestic consumption

Pork consumption in Colombia reached 703,000 tons in 2023, with a consumption of 13.5 kilos per capita per year. This reflects an increase of 487% in the last decade, the highest in Latin America. Although pork still ranks third in animal protein preference, behind chicken (46.8 kg per capita) and beef (23.1 kg), consumption is expected to exceed 15 kg per capita by 2025. This growth has been driven by promotional campaigns, which seek to strengthen the positioning of pork in the local market.

Imports and exports

Despite the strong growth of national production, Colombia remains a deficit market since it needs to cover the growing domestic demand. Therefore, they need to import large quantities of pork, which has registered an increase of 21% between 2019 and 2023. In 2023, 140,161 tons of pork were imported, mainly from the United States (68%), Canada (14.8%), Chile (13.8%) and Spain (3.3%). These imports consist primarily of frozen meat (88.9%), offal and processed products. In contrast, Colombian exports were minimal, with only 1,950 tons exported that year.

Spain, one of the leading suppliers to the Colombian market, exported 4,640 tons in 2023, standing out in products such as bacon, cured hams and sausages. The Spanish market share, however, has decreased slightly compared to previous years.

Perspectives

With a projected growth of 6.2% in production and a 1.7% increase in domestic consumption in 2023, the Colombian pork sector is emerging as a key driver of the country's agricultural economy. The outlook for 2025 is optimistic, with greater mechanisation of farms and constantly rising domestic consumption, which could reduce dependence on imports in the medium term.

In addition, Colombia seeks to consolidate its sanitary status and advance in the technification of the pork industry, aligning itself with international standards. This includes adopting more sustainable and ethical practices that reduce costs and meet the growing expectations of local and global consumers.

Source: Interporc.